QDutch TTF Gas Hub may become an Important European Benchmar

Increased pipeline and storage capacity, as well as new LNG handling facilities, have helped support the development and evolution of natural gas trading hubs in Europe. While hurdles remain before hubs provide reliable price preference over contracts, some key developments show that spot markets will continue to grow in the near-term.

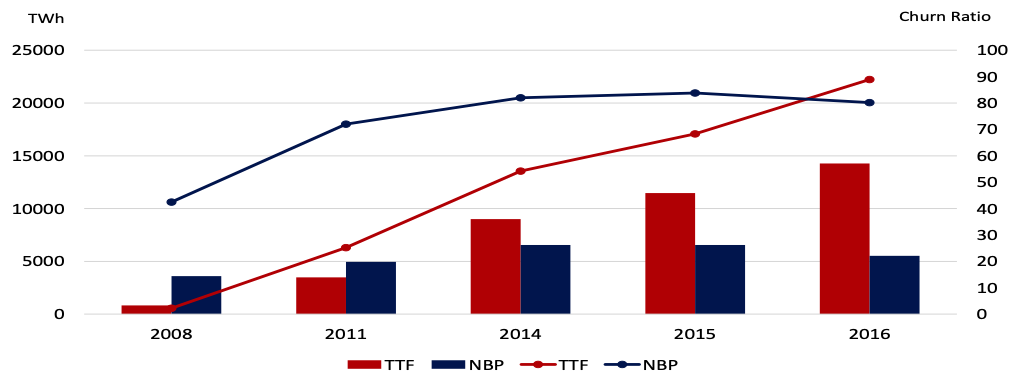

Britain’s National Balancing Point (NBP) was historically the closest gas hub to a European benchmark. In recent years, the Dutch TTF hub has provided traders an alternative market in Europe, and as shown in Figure 1, TTF surpassed NBP last year to become the primary European hub based on the total traded volumes (TWh). The number of companies that actively trade on TTF grew by 25% since 2014, while the number of traded products continues to grow, with a significant number of trades extending beyond the front-month contract. This provides further-out trading liquidity.

TTF has also overcome NBP in terms of the churn ratio, which is the multiple of traded volume to actual physical throughput. A common rule-of-thumb is that commodity markets are deemed to have reached maturity when the churn is in excess of 10 times.

In the wake of Brexit, TTF may become the primary European hub. Based on its growth in the aforementioned areas, it may also become a true gas benchmark in Europe. This would provide an important mechanism for price discovery in Europe, for hedging U.S. LNG into Europe (due to the further-out trading liquidity), and for providing an alternative supply to long-term Russian contracts. However, due to transportation costs and other factors restricting natural gas trade between Northern or Western Europe and Southeastern Europe, there is a need for a regional gas-pricing hub in Southeastern Europe (Turkey would be in an excellent position to provide this).