OPEC Meeting Fails to Rally Prices

Brent crude traded above $54/b for the first time in a month this week as oil prices gained momentum ahead of OPEC’s meeting on May 25. This 5.5% increase was the best since December, propelled by recent statements by Saudi Arabia and Russia that they support extending the production cuts until March 2018.

Following the announcement from OPEC that cuts would continue through March 2018, prices fell sharply to $51.46/b on 25 May, and were trending downward the following morning. Despite OPEC and Russia, agreeing to cut production by a combined 1.8 million barrels per day (mb/d), traders expected larger cuts in order to sustain the recent declines in global oil inventories. OPEC is responsible for 1.2 mb/d of the cuts. Compliance for OPEC countries has averaged near 96%, while Russia has lagged behind at 60%.

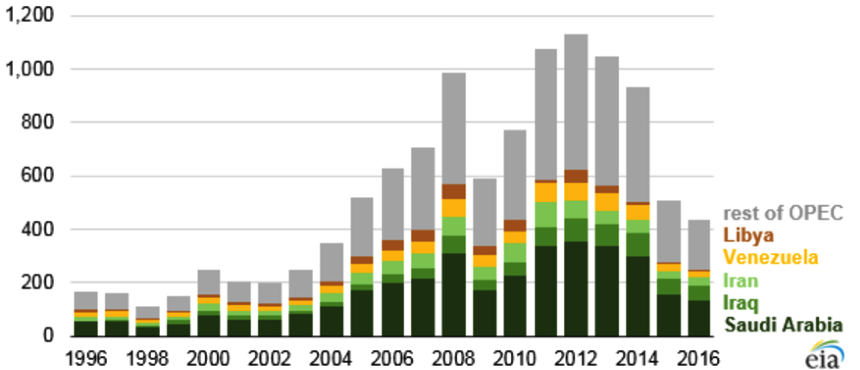

Through the first three months of 2017, OPEC net oil export revenues increased, according to the International Energy Agency (IEA), compared to the previous quarter due to increased prices outweighing the lost barrels. OPEC’s net oil export revenues were down significantly in recent years, mostly due to the fall in oil prices. 1 According to the U.S. Energy Information Administration (EIA), OPEC revenues were roughly $433 billion in 2016, the lowest since 2004 (Figure 1).

With OPEC’s commitment to keep production near 32 mb/d until March 2018, the International Energy Agency (IEA) estimates that global stocks will decline by 0.7 mb/d in 2Q17. The oil market was nearly balanced in 1Q17 as OECD crude stocks grew by 0.3 mb/d while stocks fell by 0.2 mb/d elsewhere.

Much depends on whether we will see significant production growth in the United States, Nigeria and Libya (Nigeria and Libya are OPEC countries but are excluded from the supply cuts).