DOES THE ATTACK ON SAUDI OIL PRODUCTION SUGGEST THAT WE MAY SOON SEE ANOTHER WORLD OIL CRISIS?

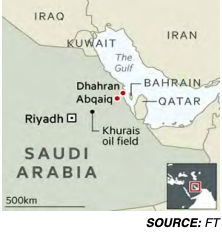

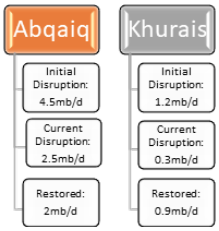

The Attack and Restoration of Saudi Production: The 14 September attack on Saudi Arabia’s oil infrastructure was a stark reminder that the over-supplied global oil market consumers have enjoyed since 2014 continues to have significant supply risks. The damage suffered at Abqaiq and nearby fields knocked out more than half of Saudi production capacity and also dented Saudi Arabia’s longheld reputation as a reliable supplier of oil. Nonetheless, production has been quickly restored. Ibrahim AlBuainain, the chief executive officer of trading arm of Saudi Aramco said that they have restored full oil production and capacity to the levels they were at its pre-attack level of about 9.7 million barrels per day as of Sept. 25 and even “a little higher” to replenish inventories. Before it was apparent that production would be restored so quickly, markets reacted quite mildly to the attack especially compared to past disruptions of a similar or even much lesser magnitude.

Market Response: When markets opened on Monday, 16 September after the weekend attack, the price of Brent oil rose as much as 20% with the initial fear of more prolonged supply disruption (prices reached $72 a barrel) but then closed at $69 and later on slumped back to $64. The U.S. benchmark, West Texas Intermediate, increased 16% reaching $63 a barrel before declining on the 16th of Sept. This price response was much lower than those resulting from past supply disruptions. Past price spikes were much larger often causing

relatively high historic real oil prices and typically causing a significant decrease in real worldwide GDP growth. While the circumstances involving this disruption did not signal a continuing outage as it was clear that Aramco would be able to bring the damaged units back online, the geopolitical risks of increased regional conflict could have been a major concern to markets.

The attack has not only underscored the vulnerability of the world’s top oil exporter’s infrastructure, but regional tensions could worsen and further threaten the Mid-East oil supply lifeline (especially to Europe and Asia), nonetheless, markets do not appear to have added a larger risk premium to oil futures. Part of the comfort may come from the assurance by the International Energy Agency states that, “We are in contact with Saudi authorities as well as major producers and consumer nations. For now, markets are well supplied with ample commercial stocks.” The IEA strategic petroleum stocks, especially those in the U.S., Japan and Germany as well as Chinese

stocks provide a large insurance policy that can keep global oil prices at reasonable levels for an extended period of time.

Nonetheless, the airborne attack was aimed at Kingdom’s largest oil fields, the Hijra Khurais, producing 1.3 mb/d and the Abqaiq oil facility, one of the most important oil facilities in the world with a capacity of 7 mb/d. The world biggest oil fields, namely: Ghawar, Shaybah and Khurais crude production come to Abqaiq oil facility before being sent to the customers around the world. Abqaiq is a complex facility that is not only

responsible for processing over half of Saudi Arabia’s oil production but also produces 700,000 b/d of NGL’s (2018 data). The quick restoration of Abqaiq’s operations and Saudi productions should not diminish concerns that Middle East processing centers and choke points remain vulnerable to disruption due to unforeseen circumstances and restoration of supplies could take longer.