World Energy Outlook 2020 Reveals Pathways on How to Use Covid Crisis for a Faster Energy Transition

The 2020 edition of the IEA World Energy Outlook was launched on October 13. This issue was particularly anticipated due to the deep disruptions to global energy markets caused by the Covid-19 pandemic. It focused on two key questions: How might the pandemic and its aftermath reshape the energy sector, and does this disruption help -or hinder- the prospects for rapid clean energy transitions?

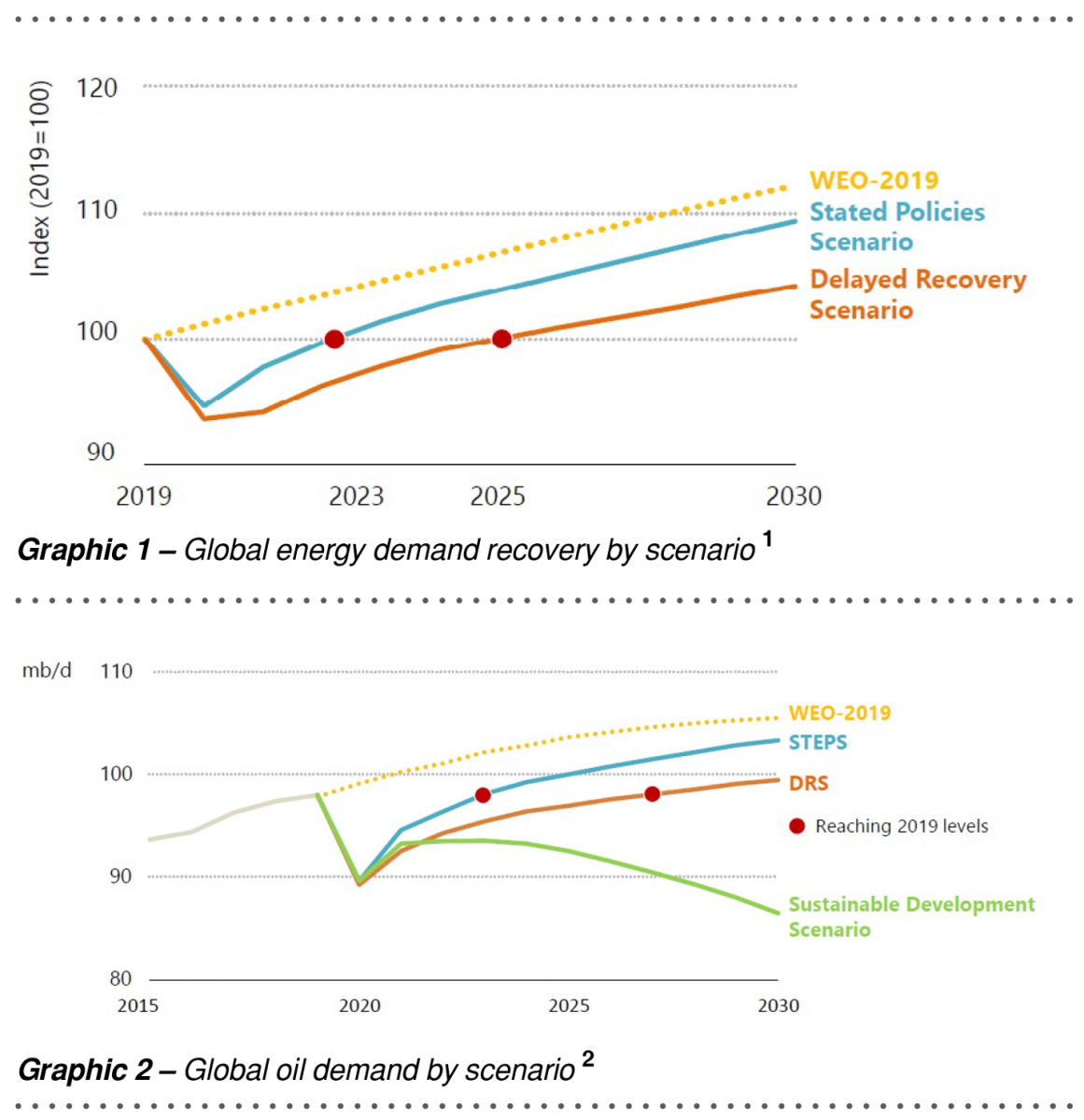

According to the latest IEA analysis, the pandemic caused, during 2020, a 5% drop in global energy demand, a 7% drop in energy-related CO2 emissions, and an 18% drop in energy investments. As shown below, the short term impact of the pandemic was severe with two longer term scenarios for recovery: the Stated Policy Scenarios showing a gradual resumption towards the projection shown in last year’s 2019 WEO and a Delayed Recover Scenario showing a longer lasting brake on energy demand.

The Stated Policies Scenario assumes that the pandemic will be brought under control in 2021 and global economic indicators will rebound to pre-crisis levels in early 2023. The Delayed Recovery Scenario assumes the same pandemic and economic recovery but shows lasting impacts on energy demand.

A third Sustainable Development Scenario shows the consequences of stronger policies, following the Covid crisis to speed up sustainable energy development. A more aggressive net-zero emissions by 2050 Scenario assumes that there would be a widespread push towards net-zero emission technologies.

This scenario also shows what changes would be needed during the next decade to meet the netzero goal in time to avoid a 1.5°C rise in global temperature.

All of the scenarios show a declining share of coal use with coal use falling below 20%, a historic low since the industrial revolution. The fall in power demand because of the Covid-19 and coal’s high GHG emissions create major investor uncertainties for coal plants. Transport fuels have also been

hard hit showing a slower recovery for oil demand growth as shown below. The Delayed Recovery Scenario (DRS) shows that world oil demand will still not exceed 100 million barrels per day, a target that was expected in past projections to be passed during 2021. “The era of global oil demand growth will come to an end in the next decade.” Dr. Fatih Birol, the IEA Executive Director said. “But without a large shift in government policies, there is no sign of a rapid decline. Based on today’s policy settings, a global economic rebound would soon push oil demand back to pre-crisis levels.”