COVID-19 Crisis is Causing the Biggest Fall in Global Energy Investment: IEA

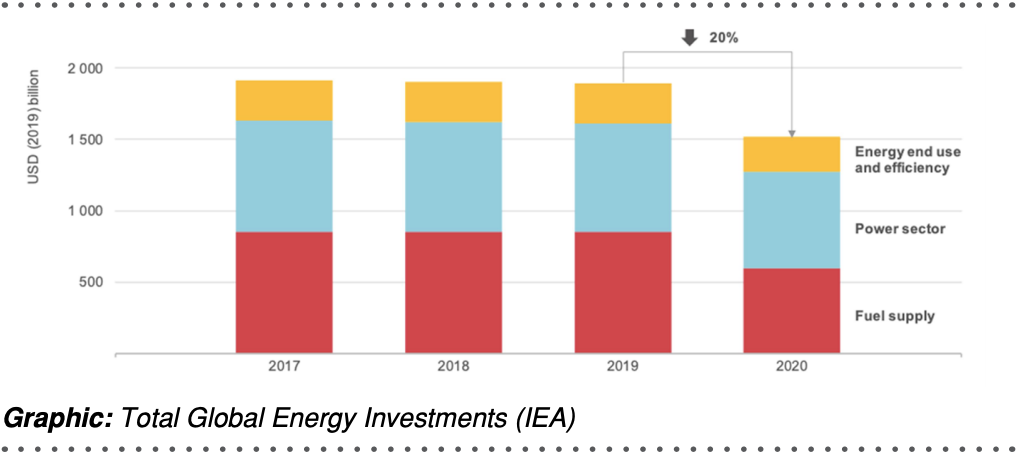

The unparalleled decline in worldwide energy investment had been “staggering in both its scale and swiftness,” revealed the annual World Energy Investment Report of the International Energy Agency (IEA), published on May 27, 2020. The coronavirus pandemic has paved the way for the largest decline of global energy investment in history, with spending set to plummet in every major sector this year, said the report. The IEA’s executive director and IICEC’s Honorary Board Chairman Fatih Birol said that a historic $400 billion decline in overall energy investment in 2020 is expected, and the global power sector will account for almost $80 billion of that, “a record 10% drop that takes spending down to the level it was at a decade ago,” during his remarks at the Global Energy Policy webcast of Columbia University, on May 28, 2020.

“The COVID-19 crisis has highlighted how much modern societies depend on electricity and has ‘squeezed’ the capital flows on which a healthy electricity sector depends,” he emphasized.

“The historic plunge in global energy investment is deeply troubling for many reasons,” said Fatih Birol, in a statement.

OAt the beginning of 2020, the Paris based agency said the global energy investments were on pace for the growth of around 2%, reflecting the largest annual rise in spending in six years. But, after the COVID-19 outbreak brought large swathes of the world economy starting from march, and the IEA now expects global investment to tumble by 20% compared to 2019.

The combination of falling demand, lower energy prices, and a rise in cases of non-payment of bills means that energy revenues going to governments and industry are set to fall by $1 trillion in 2020, according to the report.

The report states that the COVID-19 pandemic has brought with it a major fall in demand, with high uncertainty over how long it will last.

“Under these circumstances, with overcapacity in many markets, a cut in new investment becomes a natural and even a necessary market response,” the report added.

However, the slump in investment may not turn out to be proportional to the demand shock, and the lead times associated with energy investment projects mean that the impact of today’s cutbacks on the energy supply (or demand, in the case of efficiency) will be felt only after a few years, when the world may be well into a post recovery phase, according to IEA.

Countries in full lockdown are experiencing an average 25% decline in energy demand relative to typical levels and countries in partial lockdown an average 18% decline, the report showed from the analysis of daily data through mid-April.

The World Energy Investment report warned the economic impact of the public health crisis could have serious implications for energy security and clean energy transitions.